Bakery Market Report 2024

Top 75 businesses

1 (1)

Costa

Stores: 2,677

Change: -19

Employees: 18,264 (company-owned stores only)

Strong seasonal menus, collaborations, and expansion were top of the agenda for Costa in 2023. The coffee giant may have reported the second biggest drop in store numbers on this list, but the 19 stores only equate to 0.7% of its estate. Sales for the year, meanwhile, were reportedly strong. Although owner The Coca-Cola Company didn’t reveal exact figures, it said the 3% uplift in its overall coffee sales for the year ended 31 December 2023 was benefited by Costa’s performance in the UK and China. The uplift will be good news for CEO Philippe Schaillee who stepped into the role in April 2023.

Costa opened several new locations in Tesco stores during 2023 as it looked to expand its UK footprint, with Chichester and Ashford among the new sites. The business also opened several drive-thrus, including ones in Kendal, Wakefield, and Warrington, throughout the year, as well as units in two major London train stations – Liverpool Street and St Pancras International.

Supermarkets also remain of interest and Costa kicked off 2024 with a Sainsbury’s partnership which will see the coffee specialist open new cafes in 11 of the retailer’s stores.

Seasonal menus continue to be a mainstay of Costa’s product offering as it frequently unveils limited-edition sweet and savoury menu items, as well as hot and cold drinks, throughout the year. Highlights for 2023 included a Pigs & Blanket Toastie, Sticky Toffee Loaf Cake and accompanying Sticky Toffee Latte, and Vegan Turkey & Trimmings Toastie for Christmas, as well as a Hog Roast Toastie and Chocolate & Salted Caramel Cake for autumn.

It continued this trend into 2024 with new products for Veganuary, including an expansion of its range with vegan brand Bosh!, and Plant-Based Saucy Chicken Fajita Wrap.

Another continued theme was pay rises for staff. In 2023, employees at company-owned Costa sites received wage increases of between 6.1% and 7.3% as it invested £12m in pay and team benefits. For 2024, the average pay rise equates to 9%.

2 (2)

Greggs

Stores: 2,473

Change: +145

Employees: 32,000

Greggs has seen the largest net growth in shop numbers of any company on this report for the second year running. If it keeps up this rate of growth, which it intends to with 140 to 160 openings on the agenda for 2024, it could be leaping into the number one spot soon. Its ultimate goal is to have more than 3,000 shops in the UK, although it hasn’t set an exact timeline for this.

This growth is reflected in its revenue as well, with sales for the 52 weeks ending 30 December 2023 up 19.6% to £1.81bn. What’s more, the food-to-go giant said it is on track to double its sales by 2026 thanks to its strategic plan which includes broadening the customer appeal, growing and developing its estate, investing in the supply chain, and embracing digital channels and longer opening hours.

Greggs diversified its shop estate in 2023 with further openings in the travel sector, including its first site at a London airport, more roadside locations, retail parks, and expansion of drive-thrus.

Notably, Greggs is a vertically integrated company meaning it owns and operates its manufacturing sites and handles logistics. Production of savoury bakes and rolls is set to increase by 35% over time owing to investment in its Balliol Park factory in Newcastle-upon-Tyne while an additional pizza line at its Enfield location, which came online in late 2022, has helped double capacity there.

3 (3)

Subway

Stores: 2,291

Change: +21

Employees: N/A

Subway bounced back from its performance in 2022 which saw it drop into third place on the Bakery Market Report (where it remains) as 130 stores closed. While not back to its previous size, the wholly franchise operated business added 21 sites to its portfolio this year.

The sandwich specialist also revamped its menu in 2023, rolling out the Subway Series Menu which marked the ‘most meaningful change’ in the brand’s nearly 60-year history. The menu comprises 15 set fillings which consumers can choose from, although they can still opt for its fully customisable option. The predominantly American-style flavours include the likes of Notorious B.M.T., Tex Mexan, Big Breakwich, and Great Caesar, as well as plant-based offerings like the Meatless Philly.

Even bigger news came from across the pond as the business was acquired by affiliates of private equity firm Roark Capital. The transaction was described as a ‘major milestone’ in Subway’s multi-year transformation journey.

4 (4)

Starbucks

Stores: 1,156

Change: +90

Employees: N/A

Starbucks secured the second biggest net store gain in 2023, beat only by Greggs. It added 90 stores to its portfolio representing an 8.4% increase on the previous year. The coffee giant is hoping to keep up this momentum with 100 new stores planned for its 2024 financial year with Chester, Birmingham, Manchester, and Harrogate among the locations due to open.

Strong growth was also reported for Starbucks’ revenue which hit £547.7m for the year ending 1 October 2023, marking a 21.9% increase from the prior year. Profit also rebounded rising to £21.7m.

Operational highlights contributing to the growth included investments in drive-thru stores, delivery services, and digital channels, such as mobile order and pay systems. In addition, improvements to the loyalty program saw a 100% increase in 90-day active membership, going from 600k to 1.2m.

What’s more, Starbucks said the value of an average customer basket has increased year on year, driven by the increase in popularity of its cold beverages as well as food, with items such as egg bites and cake pops performing strongly.

5 (5)

The Nero Group

Stores: 762

Change: -15

Employees: 5,281 (UK)

Caffè Nero owner The Nero Group described its 2023 financial year (which ended in May 2023) as one of recovery following the pandemic. It has reported 17% sales growth in the six months since then.

In March 2023, the business increased its ownership of Coffee#1 to 100% after buying the remaining 23.5% from its co-investor. The number of Coffee#1 sites has risen from 101 to 117 in the past 12 months, a sign of the groups' confidence in the brand.

In contrast, a slew of Harris & Hoole coffee shops closed in 2023 after an agreement between The Nero Group and Tesco came to an end. At the time, the business said it had a pipeline of standalone openings planned for the brand.

While the total number of Caffè Nero sites has dipped in the past year, the brand is to open its first-ever drive-thru site, at Stansted Airport, this year. The business has invested £1.2m in the 1,200 sq ft store, which has been built from scratch with a bespoke design that will be used as a template for further drive-thru stores in the future.

6 (6)

SSP

Stores: 470

Change: 0

Employees: 8,600

"Overall, 2023 was a solid year of organic and new space growth," declared SSP UK & Ireland CEO Kari Daniels in the business' 2023 annual report.

The Upper Crust and Millie's operator, which focuses on travel locations, reported that growth in air travel volumes had contributed to the recovery of the travel industry, but it had faced challenges including railway industrial action and rising costs.

Despite the impact of rail strikes, sales recovered to 85.2% of 2019 levels in the first half of 2023 and averaged 97.8% of 2019 levels in the second half.

In November, SSP announced the launch of Café Local, a travel-focused foodservice and retail store concept tailored for UK regional rail stations. Gatwick Airport has also been a focus for SSP in the past year, increasing its brands at the site from two in 2019 to six in 2023. In a tie-up with the Scottish brewer, it opened a BrewDog site at the airport in December, and in July opened the first airport restaurant with London-based brunch brand The Breakfast Club.

7 (7)

Pret A Manger

Stores: 460

Change: +23

Employees: 7,500

With little sign of pressure on consumer spending easing, price has been a focus for Pret. The business launched the Made Simple range of value sandwiches in January 2023, and this year cut the cost of some of its bestsellers after coming under fire in the press for hiking prices.

Among the net 23 sites opened by Pret in 2023 was its first shop in Northern Ireland, in Belfast city centre, following the opening of three shops in Dublin by longstanding franchise partner Carebrook Partnership. Pret hopes to expand its estate in Ireland and Northern Ireland to 20 shops within the next decade.

The business has also rolled out its first dedicated kids' menu. Aimed at children aged four to 10, it includes sandwiches, toasties, and yoghurt pots.

“We continued our growth journey in 2023, driven by the success of our franchise model and the pace of our transformation," says Pret UK managing director Clare Clough. "Our ongoing investment into Pret’s loyalty proposition and digital channels helped us on our way too."

8 (8)

BP Wild Bean Cafe

Stores: 335

Change: 0

Employees: 6,500

With 312 company-owned stores and 23 franchises, BP’s Wild Bean Cafe format was static on numbers in 2023. Nevertheless, it was a busy year for the firm. BP has been piloting food-for-now ranges, prepared in front of customers, to elevate the Wild Bean Cafe foodservice offer. It is also marketing self-serve Wild Bean Cafe Express units to dealer (franchise) sites. These modular units take payment and can reduce queues.

A highlight of 2023 was the growth of Wild Bean Cafe's savoury bakery sales, driven by an NPD programme that is serving “hunger need at a lower cost”, BP says. The top product launch in 2023 was a Luxury Sausage roll while the bestseller remains the Bacon & Cheese Turnover. The focus for 2024 is compelling NPD focused on key seasons and classic flavour profiles, including new cheeseburger slice savouries and iced doughnuts launching soon, and more food-for-now pilots.

9 (9)

Cake Box

Stores: 217

Change: +16

Employees: 173

Cake specialist Cake Box, which uses dairy but not eggs in recipes, added 16 shops in 2023, in towns including Liverpool, Cambridge, and Cheadle. The company, which floated on the Alternative Investment Market in 2018, wants to become the UK’s leading multi-channel cake business with a medium-term target of 400 shops. Three-quarters of its stores are operated by franchisees, around half of whom operate more than one shop.

A focus of 2023 was boosting marketing activities and driving brand awareness. In June, Cake Box launched its new website which increased sales and improved customer experience, it says.

New product development was also key in 2023, with the launch of a premium mango range being a highlight. New premium ranges help franchisees grow their margins through pricing, the company notes.

A new brand identity and fascia is being rolled out this year, which CEO Sukh Chamdal said would “broaden the appeal of our brand to new customers and demographics, amplifying the opportunity for new store openings”.

10 (10)

Cooplands

Stores: 159

Change: -31

Employees: 1,572

It was a tough year for Scarborough-headquartered Cooplands which saw the biggest reduction in number of stores of all the companies in this report. Under its owners EG Group, just over 15% of its estate was shuttered, along with its Hull bakery. Production was absorbed into its remaining Scarborough and Durham sites which the firm said would help reduce overhead costs and create greater synergies through production.

The move came off the back of a ‘challenging’ financial period in which Cooplands reported a loss of £9.8m for the 39-week period to 31 December 2022. This was in stark contrast to EG Group’s plans a year prior when it outlined ambitions to open 30 Cooplands outlets a year.

Positive steps have been taken in 2024 as it sparked a deal with Nisa to supply Yorkshire-made baked goods, including loaves, buns, and cakes, to its stores. Cooplands also rolled out Cybake ISB software across its entire estate as it looks to boost sandwich trade, which currently accounts for almost 30% of its revenue.

11-30

11 (12)

Krispy Kreme

Stores: 144

Change: +23

Employees: 1,932

Krispy Kreme ranks joint third (with Pret A Manger) for the biggest net gain to its estate in 2023. It’s a strong position to be in for a company which celebrated its 20th anniversary in the UK the same year. The openings form part of Krispy Kreme’s plans to put more doughnuts in the hands of more consumers. At present, around half of the UK has access to its products through its stores and 1,750+ cabinets in supermarkets and other retailers, which offers huge potential for growth. The doughnut specialist sprung into 2024 with a new flagship store on London’s Oxford Street, while UK&I MD Jamie Dunning said expanding into the convenience sector was a key part of the plan for the year.

12 (13)

Gail’s

Stores: 129

Change: +21

Employees: 2,218

Another year of double-digit shop growth for Gail’s with expansion outside its southeast heartland. The expansion was reflected in a strong financial performance which saw Gail’s revenue rise to £135.3m for the period to 28 February 2023. It rolled into 2024 by reformulating some of its bestselling loaves to improve nutrition, flavour, and sustainability. It is now busy increasing its retail footprint further – including a first venture into the Southwest – with MD Marta Pogroszewska revealing plans to open 35 new sites by the end of the year.

13 (11)

Sayers and Poundbakery

Stores: 124

Change: -1

Employees: 1,015

Already renowned for its low pricing, the Poundbakery chain cut its prices further last summer. Its filled baguettes dropped by up to 50p to £2 each (they are now selling at £2.10), while shoppers can pick up two sausage rolls for £1.60. Recent additions to the Poundbakery line-up include a Breakfast Panini containing sausage, egg and melted cheese for £2.50, or £3 with a cup of tea or coffee. It is also capitalising on demand for home delivery, with most stores now offering this service via provider Just Eat.

14 (14)

Wenzel's the Bakers

Stores: 108

Change: 7

Employees: 1,250

Wenzel's opened seven sites in 2023 in areas including Poole, Southampton, and Portsmouth. The business's major NPD drive of the year was the Flavour Nation campaign that was designed to offer consumers tastes from around the world and featured products including Sugar and Cinnamon Churros and a Chicken Tikka Baguette. Wenzel's plans for 2024 include further store openings and new campaigns building on the success of initiatives such as its Baking a Difference price reduction drive.

15 (16)

Foodco UK

Stores: 86

Change: 7

Employees: N/A

Franchise business Foodco UK operates the Muffin Break and Jamaica Blue brands. It opened further sites under both in 2023, with Muffin Break growing by five outlets to 66, and Jamaica Blue by two sites to 20. Originally a Canadian operation, before being acquired by Australian business Foodco Group, Muffin Break opened its first site in Northern Ireland in 2022 and has continued to expand in the country with a new site in Belfast opening last summer.

16 (21)

Black Sheep Coffee

Stores: 79

Change: +17

Employees: 442

Robusta coffee chain Black Sheep, which calls itself the UK’s fastest-growing specialty coffee chain, opened 17 new UK franchise outlets in 2023, in locations including Peterborough and Preston. Founded in 2013, Black Sheep plans to continue UK expansion this year, and launch franchise stores in Texas, USA and the first of 250 outlets in the United Arab Emirates. Black Sheep Coffee’s parent company Conilon Ltd raised additional financing after posting a £5.8 million loss after tax in its last reported financial year (2022) on turnover of £21.3m. Directors stated that they were confident of liquidity until the end of 2024, and the expansion continues.

17 (18)

Tim Hortons

Stores: 78

Change: +6

Employees: 2,100

Tim Hortons has stormed its way up the Bakery Market Report ranking from its inaugural entry in 2021 – although it opened its first UK store in Glasgow back in 2017. Its rate of growth over the past year has slowed compared to the previous few in which it opened 20-plus sites consistently. Further growth is on the horizon though, as Tim Hortons unveiled a franchise model for the UK in September as it looks for operators from across the nation with a record of delivering brand standards, delighting customers, and driving sales.

18 (15)

Causeway Capital

Stores: 75

Change: -13

Employees: 709

Patisserie Valerie and Bakers + Baristas owner Causeway reports growth across all its channels, including stores, online and through its retail partnership with Sainsbury’s. "This has been driven by our relentless focus on our customers, clarity of our market positioning for each brand and a tailored approach across each channel," says the business. It plans to open five Bakers & Baristas in 2024 and will convert more Patisserie Valerie sites to the format introduced at its flagship Cribbs Causeway site in December.

19 (17)

Café W (Waterstones)

Stores: 73

Change: 0

Employees: N/A

Bookshop operator Waterstones has been bringing its cafés in-house under the Café W brand since 2014, when the format made its debut. The retailer states that Café W sources its products locally and ethically as much as possible and sells triple-certified coffee made from 100% Arabica beans. As well as offering a range of food and drinks, the cafés provide a space suitable for use as a location for book launches and readings. Menu items include toasties, cakes, cookies, and seasonal sweet treats alongside hot and cold drinks.

20 (19)

Cooks Coffee Company

Stores: 71

Change: +1

Employees: N/A

Franchise operator Cooks Coffee remains gung-ho about the UK expansion of its Esquires brand, despite its Triple Two coffee business going into administration in 2023. Triple Two, which had 20 outlets at the end of 2022, had been adversely impacted by the current market environment, it said. Esquires, however continues to perform in line with expectations and is making a positive contribution. Cooks plans to expand click & collect, delivery, and loyalty programmes, and expand internationally.

21 (21)

Joe & The Juice UK

Stores: 67

Change: +5

Employees: 479

US private equity firm General Atlantic took a controlling stake in the Joe & the Juice chain at the end of 2023, with plans to continue its global expansion in the UK, Europe, the US, and the Middle East. The company, which offers fresh juices, shakes, coffee and sandwiches, was founded in Denmark in 2002 and came to the UK in 2009. It has since expanded from Greater London into cities including Liverpool, Birmingham, and Manchester, while looking to evolve into a lifestyle brand through partnerships and develop a range of merchandise in the future.

22 (20)

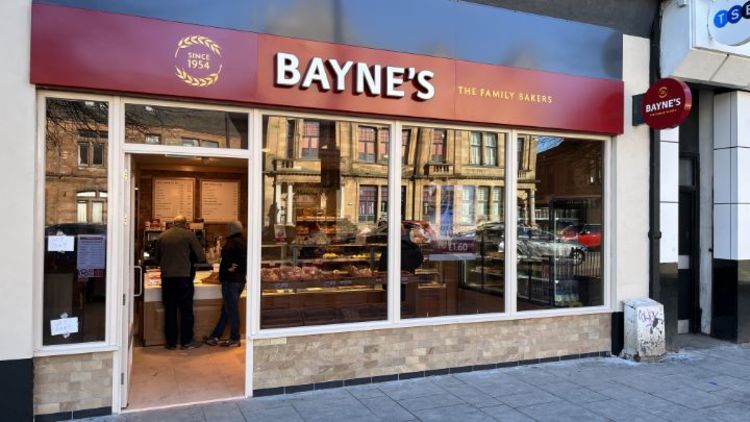

Bayne’s the Family Bakers

Stores: 65

Change: +1

Employees: 920

John Bayne, joint MD of Bayne’s the Family Bakers, says the company saw good sales growth in 2023. On the downside, it was affected by high staff turnover, which made an ongoing recruitment drive necessary during the year. The Fife-based bakery, which has shops across central Scotland, opened two new locations in 2023 – in Straiton, Midlothian and Barrhead, Glasgow – for a net gain of one. It also added stores to Just Eat’s delivery service with 45 on the platform by year end, with more to follow. Bayne's rolled out the ‘Too Good To Go’ food rescue scheme across all shops, having first signed up in 2022. For 2024 the plan is to open four more shops.

23 (21)

The Cornish Bakery

Stores: 63

Change: +1

Employees: 636

Turnover increased at independent business The Cornish Bakery with sales up 20.6% to £23.6m for the 53 weeks to 1 June 2023. It’s a strong position to be in as it looks to double or triple its estate in the coming years. For now, it has plans to open at least 10 new sites in 2024 with Lewes in East Sussex the first one in the pipeline. “All of the new site openings planned for this year will be regular high street locations within small to medium-sized towns and cities across the UK,” said founder and owner Steve Grocutt, adding “there are significant opportunities across the country and we’re going for it.” It is currently on the hunt for a MD to help “lead it to the next level”.

24 (21)

Birds Bakery

Stores: 61

Change: -1

Employees: N/A

Store numbers were more or less the same at East Midlands-based Birds Bakery but there was a host of activity behind the scenes as it geared up to unveil new branding for 2024. The family-run and owned bakery kicked off the rebrand at its Ashby-de-la-Zouch shop and will gradually roll out the new green branding to its estate. Strategy director Jamie Bird said the move was about more than a visual transformation, its about “showcasing both tradition and innovation”. The bakery also pushed significant investment in coffee as it embraced an exclusive partnership with Nottingham roasters 200 Degrees Coffee.

25 (28)

Hotel Chocolat

Stores: 49

Change: +4

Employees: 962

Some 49 of Hotel Chocolat’s 126 UK stores had cafes at the end of 2023, with new locations including Banbury and Orpington. It also started experimenting with a new Velvetiser Café format for out-of-town shopping centres (Velvetiser referring to the machine it uses for preparing smooth chocolate drinks). These stores allow a more leisurely and enjoyable shopping experience, it said, with staff on hand to give chocolate consultations. Shares in Hotel Chocolat soared following the news of its £534m takeover by US food giant Mars in November 2023. It said the deal would allow faster growth, including overseas.

26 (25)

Parsons Bakery

Stores: 48

Change: 0

Employees: 429

Bristol-based Parsons Bakery expanded its artisan pizza delivery and collection business in 2023. Having first introduced a pizza oven to its Bedminster store in 2022, it expanded the offering to an additional three shops, taking the total to five. Parsons' 14-inch pizzas range includes anything from vegan Margherita to Carbonara. Customers can also buy pizza via UberEats and Deliveroo. Currently 28 branches offer the core Parsons range excluding drinks, via delivery platforms, and all branches have click & collect. Parsons is a fourth-generation family business with sites in the southwest and the Welsh Valleys.

27 (25)

Greenhalgh’s Craft Bakery

Stores: 47

Change: -1

Employees: 558

As leases end Bolton-based Greenhalgh’s is moving into new locations. It opened three new sites, with a revamped shop front design in 2023, and expanded its mobile fleet of vans from seven to ten. It made more products available for nationwide delivery and grew its online business by 38%, says sales director Georgie Smart-Stanton. This year it plans to open branches across the northwest, and has added another two mobile stores. It will be launching an online ordering system for nationwide trade customers. Potato & meat pies will always be Greenhalgh’s hero product, Smart-Stanton adds.

28 (27)

Benugo

Stores: 45

Change: -2

Employees: N/A

Benugo celebrated its 25th anniversary in 2023, marking a quarter century since brothers Ben and Hugo Warner opened a café in Clerkenwell. Now, it has sites across the UK with a focus on travel locations and high footfall attractions such as museums, including the Natural History Museum, V&A, and Edinburgh Castle. In 2023, Benugo expanded its strategy to include the at-home market with the launch of single-origin ground coffee available to buy at its sites. All of Benugo’s locations are included in this report but where there is more than one café or restaurant at a location only one is counted.

29 (29)

Simmons

Stores: 43

Change: 2

Employees: N/A

Hertfordshire-based independent bakery Simmons invested in its operations in 2023, opening two new sites which took its estate to 43 in total. Describing itself as 'rapidly expanding', Simmons also installed a larger Koenig Combiline roll line at its central bakery in Hatfield to increase production, improve quality and provide more flexibility. Founded in 1838 by Eliza Simmons, and still run by family members, the business takes it local origins seriously and won't open shops further than 25 miles from the bakery to ensure its baked goods, including loaves, buns, and cakes, are sold as fresh as possible.

30 (30)

Warrens Bakery

Stores: 39

Change: 0

Employees: 256

‘A year of optimism’ is how Warrens Bakery described 2023 as it undertook further store rebrands, expanded its savoury pastry range, improved internal systems, and introduced a new customer loyalty app. It follows a major restructure and the completion of a Company Voluntary Arrangement which positioned it as a ‘pure retailer with strong supplier partnerships making its traditional recipes’. The move, the business said, means it has more strategic focus and greater flexibility. Significant plans to grow in travel and other high footfall sectors are on the agenda for 2024 as it looks to open more rail sites, similar to its one at Bath Spa station which was debuted in December 2023.

31-75

31 (31)

Auntie Anne’s

Stores: 38

Change: 0

Employees: N/A

Auntie Anne’s menu includes topped pretzels, pizza and even pretzel hot dogs. It's apt, then, that the brand teamed up with the four-legged heroes of kid's show Paw Patrol for a store takeover and competition in October to promote Paw Patrol's big-screen outing. It also embraced seasonal NPD with hot cross pretzels and Summer Mini Dog Skewers, and unveiled a revamped rewards programme.

32 (31)

BTC UK

Stores: 37

Change: -1

Employees: N/A

BTC Group Holdings UK says that it is focused on developing new brand footprints, e-commerce opportunities, and business partnerships for its Soho Coffee brand. It is also “cautiously assessing” development opportunities for its Euphorium brand, which has five sites in London, alongside Soho Coffee’s UK total of 32 as of the end of 2023.

=33 (33)

Puccino’s

Stores: 36

Change: 0

Employees: N/A

Puccino’s unveiled plans to expand beyond UK rail stations in 2023 as it got underway with a year of ‘exploring, learning, and developing new models’ . As part of this, a Proudly Serving model is currently under trial in a cluster of sites with a leading convenience store. It also delivered good like-for-like growth despite rail disruptions. New store openings are on the horizon for 2024.

=33 (33)

Waterfields

Stores: 36

Change: 0

Employees: N/A

Two years since completing a Company Voluntary Arrangement, family-run Waterfields reported a £1.2m hike in turnover to £13.6m in its financial year to April 2023, although profit was dented by industry-wide cost increases. The Lancashire-headquartered business also stated it had secured new wholesale business that has 'significant growth potential' for 2023/24.

35 (35)

Paul Bakery

Stores: 33

Change: -1

Employees: N/A

French chain Paul can trace its origins back to 1889 and made its UK debut in 2000 with its first bakery and restaurant in London's Covent Garden. It now has 33 sites in London, Surrey, and Oxford, selling viennoiserie, sandwiches and salads, fruit tarts, cakes and hot and cold drinks. It has yet to file its accounts for 2023, but it will no doubt be hoping for an improvement on the £2.4m loss after tax reported for 2022.

36 (36)

Ground Espresso Bars

Stores: 31

Change: -1

Employees: 230

This family owned and operated business was established in 2001 in Coleraine, Northern Ireland. In addition to its standalone Ground Espresso Bars, the business operates sites inside retailers including Next, Tesco and Waterstones. “It is our mission to provide a haven for our customers where comfort, friendship, happiness, quality and ethics become synonymous with our name,” says the business.

37 (39)

Coughlans Bakeries

Stores: 29

Change: +1

Employees: 275

Coughlans Bakery, which has been in operation since 1937, opened its latest shop on the high street in Dorking in May 2023, boosting its tally of stores around Surrey, Kent, and Croydon to 29. The third-generation family business, which specialises in vegan sweet and savoury products, also continued to roll out drool-worthy content on social media throughout the year.

=38 (37)

Dunkin'

Stores: 28

Change: -2

Employees: N/A

Doughnut and hot drink specialist Dunkin’ opened a new flagship store on London’s Wardour Street in late 2023 as part of an ‘aggressive expansion plan’ which it said would double its UK estate over the next two years. However, Dunkin’ missed its initial target to have 40 stores up and running by the end of the year and in fact reduced its estate by two sites.

=38 (41)

Jenkins Bakery

Stores: 28

Change: +1

Employees: 300

Welsh family-run firm Jenkins Bakery added a store in Swansea in 2023. Director Russell Jenkins says maintaining margins and difficulties recruiting staff in all areas were key challenges of the year. In an effort to boost sales and increase efficiency, the bakery delisted about 10% of its less popular lines, while increasing seasonal and food-to-go ones. Paninis were the top NPD.

40 (39)

Thomas the Baker

Stores: 27

Change: -1

Employees: 326

Yorkshire-based family business Thomas the Baker was forced to close its Skipton branch in April due to a shortage of staff. It opened a new shop in Middlesbrough, 200 metres away from its previous location there, following redevelopment in the area. Rolling into 2024 it opened a new shop in Boroughbridge (York), which was previously run by fellow bakery Cooplands.

=41 (50)

Bagel Factory

Stores: 26

Change: +5

Employees: N/A

The Great American Bagel Factory Ltd, to give it its full title, added five new sites in 2023, as expansion continues. These were in Ealing Broadway, Liverpool Street, and Covent Garden in London, as well as in Southampton and Luton airport. The company also launched a new loyalty app in 2023 as it continues to focus on e-commerce. Bagel Factory’s ultimate parent company is Italian catering giant Cremonini.

=41 (41)

Martins Craft Bakery

Stores: 26

Change: -1

Employees: 240

Family chain Martins focused on reducing price increases to customers and retaining staff in 2023, following cost increases on energy the year before. The chain took over the Robinsons Artisan Family Bakery shop, Greater Manchester's oldest family-run craft bakery shop, at the end of 2023. Martins’ shops run alongside a wholesale operation selling cakes and bakery products.

=41 (49)

Ole & Steen

Stores: 26

Change: +4

Employees: 571

Danish bakery Ole & Steen has doubled its estate since its first appearance in the Bakery Market Report in 2021 with stores in Windsor, Guildford, and Oxford as well as London. It introduced a grab & go concept at its Canary Wharf site in 2023, catering to commuters with a selection of hot drinks and pastries. The bakery rounded off the year by appointing a new UK MD, Graham Hollinshead, who joined from Caravan Restaurants.

=44 (50)

Batch’d

Stores: 24

Change: +3

Employees: 136

Batch’d has grand ambitions for the next few years, targeting a goal of £20m turnover and 250 staff by 2026 – a significant increase from the £6.5m figure it gave in the middle of 2023. A £250,000 loan from NPIF – Mercia Debt Finance will help the sweet treats specialist open sites and recruit staff to operate them as it looks to take its brownies, cookies, and doughnuts to a wider audience. Expansion outside of its Leeds heartland is also on the cards.

=44 (44)

Chatwins

Stores: 24

Change: -1

Employees: 250

Cheshire-based Chatwins is actively seeking new stores, after closing two sites with expiring leases in 2023 and opening a new shop in Crewe in September. It is also focusing on improving efficiencies within the business, after reporting that labour, raw ingredient and electricity costs were impacting on its bottom line. Its range is produced at a bakery in the historic town of Nantwich before being delivered to its estate.

=44 (46)

Galloways Bakers

Stores: 24

Change: 0

Employees: 177

Wigan craft bakery Galloways Bakers is big on pies, particularly matchday pies, and even hosted its own pie-eating contest in 2023. During the year it added Deep Filled Chicken & Mushroom Pies and a range of artisan breads – Italian, Honey & Spelt and Tiger bread – to the roster. In 2024 it is continuing to look for suitable locations for new stores to add to its Lancashire and Merseyside portfolio.

=44 (43)

Lola’s Cupcakes

Stores: 24

Change: -2

Employees: 426

London-based Lola’s Cupcakes said it was continuing to invest in innovative designs and products in 2023, and was focused on growing its online platform, and expanding outside its traditional southeast market. Its stores are mostly in London with other sites in Milton Keynes, High Wycombe, Birmingham, and Dorking. Seasonal NPD was high on the agenda, and it also partnered with CoolKit on an innovative delivery vehicle.

=44 (37)

Wafflemeister

Stores: 24

Change: -6

Employees: 120

Wafflemeister reduced its estate by 20% during 2023 although it plans to open two to four new sites per year in areas which are ‘best placed to continue to grow’. These will likely be leisure locations away from city centres which ‘have not yet returned to pre-Covid levels’. That said, two high profile London sites, in high tourist attraction areas, are also on the cards for the future.

49 (48)

Boston Tea Party

Stores: 23

Change: 0

Employees: 708

West Country independent chain Boston Tea Party seeks to differentiate itself as an ethical café business, “making things better”. For example, it banned single-use coffee cups in 2018 and estimates this has now saved nearly a million cups from landfill. With inflationary pressures easing it says it is set fair for the road ahead.

=50 (50)

Caffè Concerto

Stores: 22

Change: +2

Employees: 289

Italian-style brand Caffè Concerto ventured out of London in the autumn, opening in Victoria Gate shopping centre in Leeds. This was its second regional location in England after Birmingham, although there are branches in Paris, Saudi Arabia, and Qatar. The parent company changed its name to Imperial Invest and Trade in October 2023.

=50 (54)

Mr Pretzels

Stores: 22

Change: +3

Employees: 152

This franchise business sells pretzels that are based on a Pennsylvania Dutch recipe and rolled by hand before being baked and offered with a range of toppings. The first Mr Pretzels outlet opened in Puerto Rico in 1994, and business now operates more than 160 outlets in 17 countries, with 19 sites in the UK.

=50 (46)

North Eastern Bakeries

Stores: 22

Change: -2

Employees: N/A

North Eastern Bakeries was formed after Cooplands Direct went into administration in March 2023. Shops kept trading in administration until former owner Angus Steel bought them up in June. It’s the latest in a long series of administrations for what was once one of the UK’s biggest bakery chains.

=53 (57)

200 Degrees

Stores: 21

Change: 3

Employees: N/A

What started with three men roasting coffee in the corner of a garage has grown to become a business with 21 coffee shops and six barista schools. Nottingham-based 200 Degrees also has a thriving wholesale operation that, as of last year, includes supplying coffee to all Birds Bakery stores.

=53 (50)

JG Ross

Stores: 21

Change: 0

Employees: 309

As well as its shops, JG Ross now has 31 concessions in stores including Spar, as well as supplying other retailers with prepacked goods. The chain continues its shop refurbishment programme and is expanding its chilled range and launching an app this year. Its top NPD for 2023 was a Sprinkle Doughnut and a vegetarian pie.

55 (54)

Rowe’s Cornish Bakers

Stores: 20

Change: 1

Employees: 451

Supermarket expansion has been a major focus for Rowe's, with the business increasing its total number of concessions from 22 in last year's report to 40 this year. Through partnerships with retailers including Tesco and Asda, Rowe's says its brand has travelled far beyond Cornwall and Devon.

=56 (54)

Pure

Stores: 19

Change: 0

Employees: N/A

Food-to-go retailer Pure sells a wide range of baked goods including wraps and toasties from sites across London. Premier Inn owner Whitbread sold its 49% stake in Pure operator Healthy Retail last year, stating: "As Pure was not a core part of Whitbread's strategy, the group has sold its interest to a third party".

=56 (57)

Cornish Bakehouse

Stores: 19

Change: 1

Employees: N/A

Cornish Bakehouse is continuing to expand under the ownership of Bridgwater Bros Holdings, which acquired a majority stake in the business in April 2022. Founded in St Ives, Cornwall, in 1983, Cornish Bakehouse now has sites in towns and cities including Bath, Cardiff, Poole and Weymouth, and offers delivery through Just Eat.

=58 (60)

Crosstown

Stores: 18

Change: +1

Employees: 161

Seasonal and vegan-friendly NPD has been a focus for the doughnut specialist with a Gianduja, Chocolate & Hazelnut and Ginger, Blackberry & Pear among the new additions. Its estate continues to grow, although not all are counted in this report with six market stalls and seven trucks sitting outside of it with many on short leases.

=58 (63)

Truffles Bakery

Stores: 18

Change: +2

Employees: 230

Truffles grew its estate with a new site in Rustington, West Sussex and bringing The Hummingbird restaurant at Shoreham Airport (which it already operated) under the Truffles brand. The family-run firm – headed up by second generation Daisy, Amy, and Molly – focuses on traditional baked goods and celebration cakes. It also operates 10 food trucks.

=60 (71)

Crêpeaffaire

Stores: 17

Change: 3

Employees: 117

With a growing number of sites across the UK and as far afield as Kuwait, Crêpeaffaire's range of signature sweet and savoury crêpes is very much on a roll. In September last year, the brand announced a partnership with Tesco to launch a concession at the Tesco Extra store in Borehamwood, Hertfordshire.

=60 (57)

Gerrards Confectioners

Stores: 17

Change: -1

Employees: N/A

Founded in 1838, Wrexham-based Gerrards Confectioners has shops across North Wales, the Wirral and Cheshire, and operates bakery vans delivering sandwiches and baked goods to workplaces in those areas. Its wholesale operation supplies customers including farm shops, village shops, butchers, and events organisers. The business closed its site in Bangor last summer.

=60 (60)

Staniforths

Stores: 17

Change: 0

Employees: 126

Family-owned craft-bakery chain Staniforths of Rawmarsh has shops around Rotherham, Barnsley and Sheffield. NPD in 2023 included katsu chicken pasties, cheese & vegetable lattices and giant monster Halloween cookies. The bakery makes sandwiches to order in shops and also has a celebration cakes business making cakes for weddings and other occasions.

=63 (67)

Bewiched Coffee

Stores: 16

Change: 1

Employees: N/A

Bewiched was founded in 2010 in Wellingborough and now operates sites across the Midlands, including a purpose-built drive-thru that opened in Moulton Park in 2022. The brand sells its signature coffee blend through an online store and also offers barista training. Bewiched's 17th site opened in Market Harborough last month.

=63 (60)

Curtis of Lincoln

Stores: 16

Change: -1

Employees: 98

Lincolnshire bakery Curtis' history stretches back to the 1800s. It is known for its signature plum bread and pork pies. Curtis’ bakers got Coronation fever in May 2023, bringing out Coronation picnic boxes and limited-edition hand-iced Jack Russell biscuits, in honour of King Charles' two Jack Russell dogs.

=63 (67)

Dorringtons

Stores: 16

Change: 1

Employees: N/A

Dorringtons was founded in 1919 by Ernest Dorrington, who set up his bakery in Sawbridgeworth just two weeks after leaving the army. Today it operates 16 shops, with the most recent opening in Thaxted, Essex, last year. The family business also offers bespoke celebration cakes and runs a sandwich and snack delivery business across Hertfordshire, Essex and Cambridgeshire.

=63 (63)

Pieminister

Stores: 16

Change: 0

Employees: 260

Pieminister kicked off 2023 by revealing it was now a B Corp – a huge part of which it attributed to its Pies, Planet, and People goals that include targets for carbon and waste reduction and charitable giving. It also looked to improve loyalty with a new app allowing customers to earn and spend pie points in its restaurants, including its new one in Bath.

=67 (67)

Wrights Pies

Stores: 15

Change: 0

Employees: 96

The 15 shops, which sell a variety of sweet and savoury bakery items, form a small part of the Wrights business which was bought by The Compleat Food Group in late 2021. The Crewe-based manufacturer supplies pies, sausage rolls, savoury pastries, and sweet treats to retail and foodservice, and often uses its shops as a testbed for new products before being rolled out more widely.

=67 (71)

Stephens Bakery

Stores: 15

Change: +1

Employees: 245

Stephens Bakery added to its estate in late 2023 with the opening of its third drive-thru site. Found in Halbeath village, the location marked the family-run bakery’s first site in a retail park and also the first opening under new managing directors Sean and Talia Sarafilovic, who took over from their father André Sarafilovic in the summer.

=69 (New)

Friary Mill

Stores: 14

Change: N/A

Employees: N/A

One of two new entries to the Bakery Market Report this year is Plymouth-headquartered Friary Mill. Its sites are dotted across the city, serving up a variety of sweet and savoury pastries, breakfast baps, filled rolls, classic cakes, and sweet treats. Products, which are also distributed via six retail vans, are made at its factory in Cattedown.

=69 (74)

Hadfields the Bakery

Stores: 14

Change: 1

Employees: N/A

Hadfields was bought out of administration in a pre-pack deal last September by Daniel and Rebecca Birmingham, who have owned the business since 2016. While the shops continue to trade as Hadfields the Bakery, the new business is called The Bakery People. In November it dropped the price of pies and pasties, and launched new meal deals.

=69 (63)

Insomnia Coffee

Stores: 14

Change: -2

Employees: N/A

The privately owned Insomnia Coffee Company is an Irish franchise operator with a UK base in Milton Keynes. It has 143 cafes in the Republic of Ireland (which are not included in this report), and is building its UK business operating franchises with Spar and Central Co-op, as well as supplying a coffee machine offer.

=72 (74)

Ben’s Cookies (Hautecaters)

Stores: 13

Change: 0

Employees: N/A

Sporting a logo by illustrator Quentin Blake, Ben's Cookies was founded by cookery writer Helge Rubinstein and named for her son Ben. From its start in Oxford in the 1980s, Ben's now has sites in the US, Middle East, and Asia – it is opening its first store in Malaysia in December. Its latest site on these shores opened in Manchester's Trafford Centre in February 2024.

=72 (New)

Buns From Home

Stores: 13

Change: N/A

Employees: N/A

Buns From Home, which specialises in croissant buns, has popped up shops across London in recent years after being founded during lockdown. Cinnamon, chocolate hazelnut, and cardamom are among the variants available with a myriad of weekend specials making appearances including Lucky Charms Cereal Milk, Spinach & Feta, and Fig & Walnut. A site in Victoria has already joined the ranks this year with another one in Hammersmith set to follow soon.

=72 (74)

Cavan Bakery

Stores: 13

Change: 0

Employees: 180

Surrey-based Cavan Bakery tripled the size of its production facility after moving into a 15,000 sq ft purpose-built site in Walton-on-Thames. The move was coupled with investment in new machinery to help it meet growing demand for its goods which are sent to Cavan shops as well as around 100 wholesale customers. More than 80,000 items are made at the bakery every week, ranging from sandwich loaves, sourdough, speciality breads, and rolls, to sweet buns, pastries, and cakes.

=72 (67)

Doughnut Time

Stores: 13

Change: -2

Employees: N/A

Puntastic, seasonal, limited-edition doughnuts just keep on coming at Doughnut Time as it looks to tap into demand for over-the-top sweet treats throughout the year. DIY kits are still on the menu for those looking for an interactive experience at home with corporate and wedding offerings also available. Its estate has reduced slightly but Doughnut Time has returned to theme park Thorpe Park with three locations for the thrill-seeking season.

=72 (74)

Oddies Bakery

Stores: 13

Change: 0

Employees: 111

East Lancashire-based craft bakery Oddies continues to focus on keeping its costs down and managing inflationary pressures and minimum wage increases, having ridden out the energy crisis. The family chain, established in 1905, specialises in bespoke wedding and celebration cakes, as well as producing bread, savouries, and confectionery at its central bakery in Nelson.